Say you’re in the t-shirt business, and you’re serious about growing your business. Like many t-shirt companies, you may have started out selling your t-shirts on line. It’s a logical place to start given that the barriers to entry are very low. It’s a way to get in the game quickly while also providing a way to get some market feedback on your product. If you want to take your business to the next level, you will inevitably have to evaluate the costs and benefits of getting your t-shirts into physical retail stores. Achieving retail success might mean forking over the money for a t shirt display. In today’s blog, we are using t-shirts as an example, but no matter what your product, it is important that you understand the true cost of selling on Amazon as well as the cost and benefits of investing in a point-of-purchase display for your product.

Let’s start with selling on Amazon. If you haven’t noticed, the world of selling online is becoming super competitive. Not only are the barriers to entry low, but online sales are trending strongly based on things like free shipping and shifting consumer preferences. If you are searching for “t-shirts” in “All Departments” on Amazon, you’ll find that there is a lot to choose from, 5,953,819 choices to be exact.

Given the intensely competitive landscape, you will need to spend fairly heavily to get in position where you will get any looks. Those marketing and promotional dollars can add up quickly.

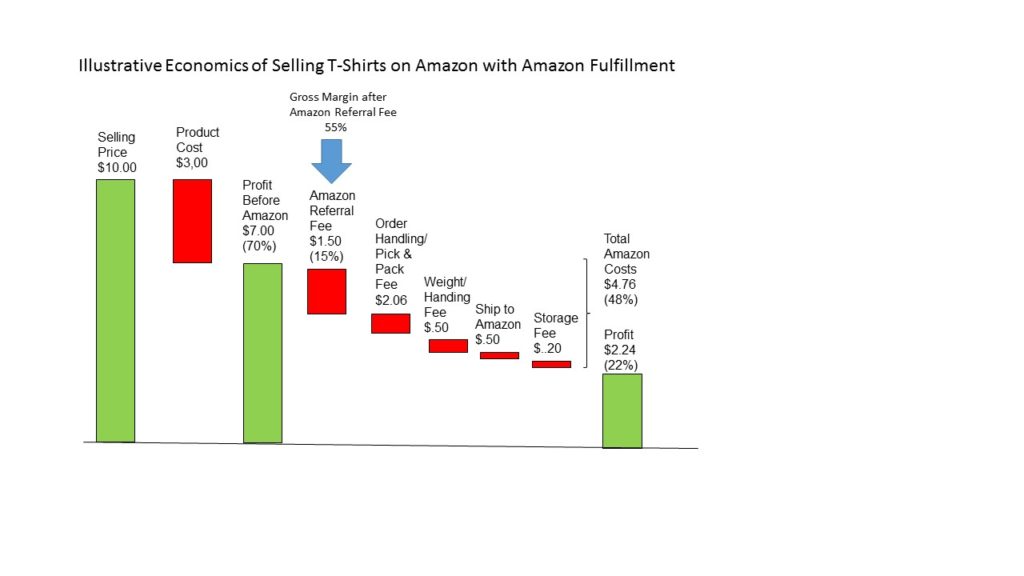

Aside from what you are spending to advertise on Amazon, it’s important to have a clear understanding of Amazon economics. Many companies think they have better profit margins than they do because they have in their head that Amazon charges a 15% seller fee, and they fail to consider other costs that they might incur.

The chart above shows illustrative economics of selling t-shirts on Amazon with Fulfillment by Amazon (FBA). The above analysis includes a number of assumptions, but we believe it to be directionally correct. This economic scenario could also change since our analysis is for selling a single t-shirt, whereas many Amazon sellers package their t-shirts in packs of 6, for example. In the above illustration, you are selling your t-shirts on Amazon for $10.00. Let’s say it costs you $3.00 to make your shirts so you have a healthy gross margin of 70%. Since Amazon charges a 15% “Referral Fee,” the adjusted gross margin after the referral fee is still a respectable 55%. At this point your gross profit on each t-shirt is $5.50.

For this category of item, Amazon charges a $1.00 order handling fee and a $1.06 pick and pack fee. In addition, Amazon charges a $.50 weight handling fee. When Amazon fulfills, you have to pay to get your product to Amazon warehouses. Even though Amazon can provide very competitive shipping rates (which generally make sense to take advantage of), there is still a shipping cost that you need to consider. In this case we assumed it would cost $.50 per t-shirt to ship to Amazon. Finally, Amazon charges an inventory storage fee. This charge depends on how much cubic volume of product they store for you and the length of time it is stored. For the purposes of this analysis, we assumed average storage fees would total $.20 per t-shirt.

The bottom line of this analysis is that Amazon ends up collecting $4.76 per t-shirt, and your gross margin (pre-Amazon) drops from 70% to 22%. None of this is really shocking, but remember that this analysis does not take into account any advertising or promotional fees that are likely to be necessary to get someone to want to buy the t-shirts. We are not suggesting that you abandon Amazon, but rather, that you run your own numbers so you can make an informed decision about the right distribution strategy for your product.

Suppose you took the $4.76 you spent per t-shirt on Amazon and instead you invested in a point-of-purchase t-shirt display for a single retail store. You could probably get a decent t-shirt display for $200 or so, but let’s assume you decided to invest a little more to get a high-capacity t-shirt cubby display like the one shown below which is a RICH LTD. stock item.

The above display would cost you about $400. Let’s assume it would also cost $100 to ship it to your target retail store. So your total investment would be about $500. Your $500 investment equates to 105 shirts sold on Amazon. If we keep the $10.00 retail selling price assumption and assume that you are selling the t-shirts to the retailer for $5.00 so the retailer can make a 50% margin, then your profit margin would be 40%, nearly double the 22% you were making on Amazon.

To recoup your $500 display investment, you would need to sell 250 t-shirts since your profit is $2.00 per shirt. The t-shirt cubby display holds 20 dozen t-shirts so you would basically have to sell through your initial order to recoup your investment. However, if the retail store is high enough volume to support a high capacity t-shirt fixture, then it is likely that you could recoup your full investment in a matter of a few weeks. Those 250 t-shirts required to break even on the $500 display would have cost you $1190 in Amazon fees- more than twice as much. What’s interesting is that once you sell the first 250 t-shirts and you have recouped your display investment, you no longer have to incur additional fixture costs presumably for several years. In contrast, the Amazon fees will continue at $4.76 per t-shirt. Therefore, on a steady-state basis you profit margins could be about twice as high in the retail store as they are on Amazon.

We would encourage you to do your own analysis and not rely on our illustrative numbers. However, we think this type of analysis might be a bit of an eye-opener for anyone selling online, irrespective of the product.

Jim Hollen is the owner and President of RICH LTD. (www.richltd.com), a 35+ year-old California-based point-of-purchase display, retail store fixture, and merchandising solutions firm which has been named among the Top 50 U.S. POP display companies for 9 consecutive years. A former management consultant with McKinsey & Co. and graduate of Stanford Business School, Jim Hollen has served more than 3000 brands and retailers over more than 20 years and has authored nearly 500 blogs and e-Books on a wide range of topics related to POP displays, store fixtures, and retail merchandising.

Jim has been to China more than 50 times and has worked directly with more than 30 factories in Asia across a broad range of material categories, including metal, wood, acrylic, injection molded and vacuum formed plastic, corrugated, glass, LED lighting, digital media player, and more. Jim Hollen also oversees RICH LTD.’s domestic manufacturing operation and has experience manufacturing, sourcing, and importing from numerous Asian countries as well as Vietnam and Mexico.

His experience working with brands and retailers spans more than 25 industries such as food and beverage, apparel, consumer electronics, cosmetics/beauty, sporting goods, automotive, pet, gifts and souvenirs, toys, wine and spirits, home improvement, jewelry, eyewear, footwear, consumer products, mass market retail, specialty retail, convenience stores, and numerous other product/retailer categories.