The overwhelming majority of our customers view retail displays as a cost or expense rather than as an investment. An “expense” mentality often leads customers to view a display as a necessary evil or as a burden that they must bear for the privilege of selling their product in a particular retailer. This type of thinking frequently leads to underinvestment in displays since expenses generally fall into the category of things we want to minimize. We believe it is valuable to set budgets for fixture programs. However, viewing your point-of-purchase display as an investment rather than an expense will result in better business decision making.

So why even spend money on a display? The 4 main reasons are:

- To gain placement in retail stores that may not be possible without a display

- To improve the merchandising effectiveness of your product or to create a home for your product within a store when space might not exist or when it does not fit into the existing plan-o-gram

- To create awareness and an identity for your brand

- To sell more products.

Together, these reasons provide the financial justification for an investment in any display program. The main difference between an expense and an investment is that an investment comes with an expectation of a return.

While most of our customers look at retail pop display fixtures as an expense rather than an investment, only a tiny minority of customers try to measure the return on their display investment. Sadly, measuring the return on investment (ROI) is a relatively straight-forward exercise that does not require an advanced degree in finance. It is really just a matter of financial discipline and good business practice. Not measuring the return on your display program is like going on a diet and not bothering to weigh yourself after 3 months.

Measuring Your Return on Investment (ROI)

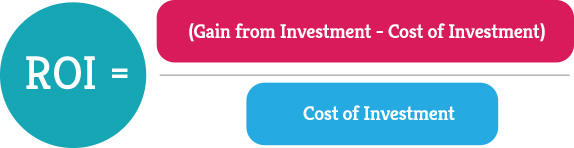

Here’s how to calculate ROI for a retail store. If you are selling your product in a store for the first time, then you can measure the ROI by taking the profit per unit sold x the number of units sold during the year (i.e., gain from your investment) minus the cost of the display divided by the display cost (expressed as a percentage). The return on investment formula is:

If for example, your profit was $10/unit, you sold 100 units during the year, and your display cost was $100, then your return on investment would be ($1000-$100)/$100 or 900%. If you expect the display to last 2 years in the store, your return would actually more than double (1900% in this case) since you could amortize the cost of the display over 2 years so your first year expense would only be $50.

If you already are selling your product in a store and have the opportunity to go “off-shelf” with a freestanding display, you may want to analyze your ROI on an incremental basis. So, for example, let’s say your product is currently inline on gondola shelves and you have no display expense. If you had an opportunity to invest $100 in a freestanding display that resulted in a 25% increase in sales which generated $500 in incremental profit during the year, then you can calculate your ROI on an incremental basis as follows: ($500-$100)/$100= 400% ROI.

In addition to ROI, there are other ways to measure the effectiveness of your display investment. One measure is the Payback Period which is used to calculate how long it takes to recover your investment.

Payback Period (In Days) = (Cost of Display/Annual Profit) x 365

In the example above, the Payback Period would be ($100/$1000) x 365 or 36.5 days. That means that the initial display investment would be recouped after a little over a month. The Payback Period calculation is another measure of capital efficiency and should generally be used in conjunction with an ROI analysis since it has 2 shortcomings as an investment measurement tool: (1) It ignores the benefits that occur after the payback period and therefore does not measure true profitability, and (2) It does not measure the time value of money.

Measuring your return on your display investment will not only help you make smarter business decisions, but you may be surprised at the magnitude of your return. Check out this mini case study to see how one of our customers generated an astounding 3400% return on his display investment and how point-of-sale displays can safeguard your investment.

Jim Hollen is the owner and President of RICH LTD. (www.richltd.com), a 35+ year-old California-based point-of-purchase display, retail store fixture, and merchandising solutions firm which has been named among the Top 50 U.S. POP display companies for 9 consecutive years. A former management consultant with McKinsey & Co. and graduate of Stanford Business School, Jim Hollen has served more than 3000 brands and retailers over more than 20 years and has authored nearly 500 blogs and e-Books on a wide range of topics related to POP displays, store fixtures, and retail merchandising.

Jim has been to China more than 50 times and has worked directly with more than 30 factories in Asia across a broad range of material categories, including metal, wood, acrylic, injection molded and vacuum formed plastic, corrugated, glass, LED lighting, digital media player, and more. Jim Hollen also oversees RICH LTD.’s domestic manufacturing operation and has experience manufacturing, sourcing, and importing from numerous Asian countries as well as Vietnam and Mexico.

His experience working with brands and retailers spans more than 25 industries such as food and beverage, apparel, consumer electronics, cosmetics/beauty, sporting goods, automotive, pet, gifts and souvenirs, toys, wine and spirits, home improvement, jewelry, eyewear, footwear, consumer products, mass market retail, specialty retail, convenience stores, and numerous other product/retailer categories.