It’s hard not to notice the consolidation that has been taking place in the retail industry. The retail industry has been under pressure ever since the economy started heading south when the Great Recession hit. As if that wasn’t bad enough for retail, Amazon and a slew of online retailers have been experiencing extraordinary growth and have continued to ratchet up the pressure on traditional bricks and mortar retailers. Beyond these macro influences, what is really driving consolidation among retailers and will consolidation continue? Here’s our retail industry outlook.

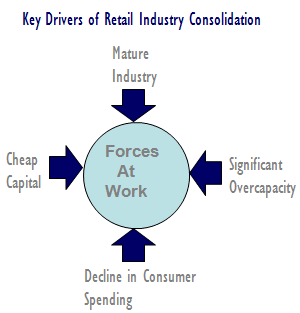

There are 4 major underlying forces at work driving consolidation in the retail industry. First, like many industries that have been around for a long time, the retail industry is mature. Well past the rapid growth phase, the industry is exhibiting all of the classic signs of a mature industry. Competitive intensity increases as industry players struggle to capture customers, and price discounting becomes a popular strategy as competitors pursue elusive growth opportunities. When industry participants find it difficult to achieve organic growth, the level of merger and acquisition activity heats up and consolidation ensues.

Second, in the U.S. over the last several decades, per capital retail space growth has far exceeded population growth, thereby creating significant overcapacity in the industry. Despite retail store closings in the past few years, the industry is still overstored. Based on 2007 Economic Census data, there were 1,122,703 retail establishments in the U.S. and a total of 14.2 billion square feet of retail space. That translates to approximately 46.6 square feet of retail space per capita in the U.S., compared to 2 square feet per capita in India, 1.5 square feet per capita in Mexico, 23 square feet per capita in the UK, 13 square feet per capita in Canada, and 6.5 square feet per capita in Australia. Industry consolidation has helped to facilitate capacity rationalization as companies merge and get acquired and the combined entities shed the worst performing stores.

Third, there has been a decline in consumer spending brought about largely by the Great Recession in the U.S. Real income growth in the U.S. has suffered which has translated into lower spending. Consumers have also been deleveraging in recent years after a running up historic per capita indebtedness. The combination of these two economic realities has put a squeeze on retail consumer spending. This, in turn, has made it difficult for retailers to achieve growth in same store sales, which has driven acquisitions as a way to secure continued growth.

Finally, consolidation within the retail industry has been driven by cheap capital. In the U.S. we have experienced a long period of historically low interest rates. When risk-free returns are low, investors turn to higher risk activities like mergers and acquisitions to achieve attractive returns. We expect interest rates to increase which may slow the rate of mergers and acquisitions over the next several years, but the other forces at work are likely to continue to drive industry consolidation during the foreseeable future.

The chart below shows just a few highlights of retail merger and acquisition activity across four retail categories. Two of these examples, the Ascena Retail Group acquisition of the parent company of Ann Taylor for $2.1 billion and the likely merger of Delhaize Group and Ahold which would form the 5th largest grocery chain in the U.S., were announced just this week.

We believe the fundamentals are in place for continued industry consolidation which will have significant ramifications for retailers as well as the retail industry’s supply chain.

Jim Hollen is the owner and President of RICH LTD. (www.richltd.com), a 35+ year-old California-based point-of-purchase display, retail store fixture, and merchandising solutions firm which has been named among the Top 50 U.S. POP display companies for 9 consecutive years. A former management consultant with McKinsey & Co. and graduate of Stanford Business School, Jim Hollen has served more than 3000 brands and retailers over more than 20 years and has authored nearly 500 blogs and e-Books on a wide range of topics related to POP displays, store fixtures, and retail merchandising.

Jim has been to China more than 50 times and has worked directly with more than 30 factories in Asia across a broad range of material categories, including metal, wood, acrylic, injection molded and vacuum formed plastic, corrugated, glass, LED lighting, digital media player, and more. Jim Hollen also oversees RICH LTD.’s domestic manufacturing operation and has experience manufacturing, sourcing, and importing from numerous Asian countries as well as Vietnam and Mexico.

His experience working with brands and retailers spans more than 25 industries such as food and beverage, apparel, consumer electronics, cosmetics/beauty, sporting goods, automotive, pet, gifts and souvenirs, toys, wine and spirits, home improvement, jewelry, eyewear, footwear, consumer products, mass market retail, specialty retail, convenience stores, and numerous other product/retailer categories.